MEMBER TOOLS

Personalized insights to get you on track for retirement

Northstar’s Retirement calculator offers custom recommendations tailored to your current finances and future goals, to help you balance today's spending with the lifestyle you want to have during retirement.

/Retirement.png?width=2000&height=1333&name=Retirement.png)

How to use the Retirement calculator

Cody, a Northstar financial advisor, walks you through how to use the retirement calculator to set your retirement goals and track your progress. The Retirement calculator enables you to:

- Easily pull in spending and saving information from the Cash flow visualizer for quick set up to see your current progress.

- Assess your current trajectory and identify changes you may want to make to achieve your retirement goals.

- See how inflation, taxes, and investment returns can affect future savings.

Not a "one-age-fits-all" retirement tool

.png)

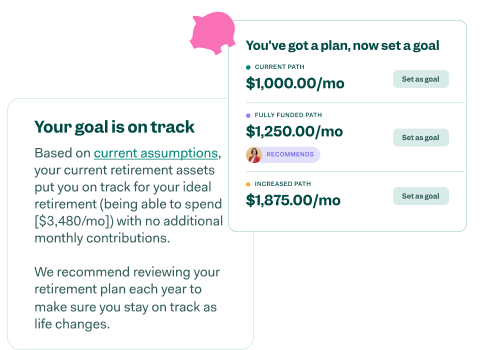

Custom progress tracking

Assess your retirement readiness based on different retirement spending amounts and monthly contributions. Input your assets to gauge whether you're on track or falling behind and need to make adjustments.

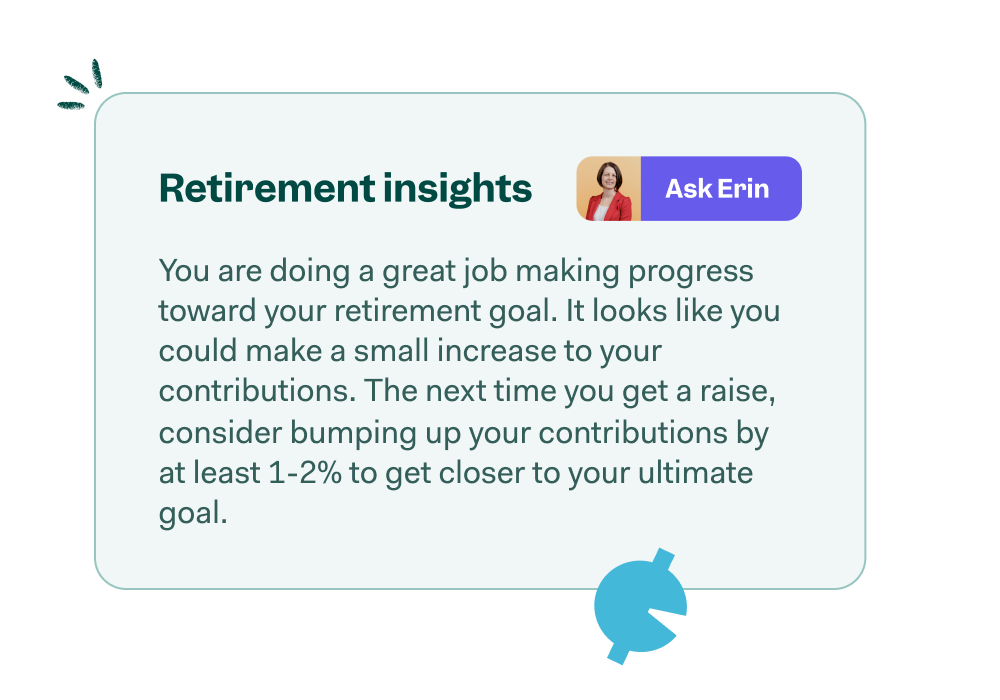

Real-time insights

Receive dynamic, custom advice about your current savings plan. These insights change based on your inputs and offer actionable advice to help you achieve your goals.

Savings guidance

Read recommendations on different savings strategies and tax considerations, such as different retirement accounts and which to prioritize when, tailored to your current financial picture and goals.